Frequently Asked Questions

OneOption is more than a trading platform. We are a methodology and the tools to execute. We provide trading research, trading technology and trading education to swing traders and full-time traders. Before you join us, take the Free 2-Week Trial. During the trial you will have full access to our suite of tools. Please take the time to review the FAQs. If you need more help, we'll be happy to help you.

Getting Started / General

The best way to get started is to read through the entire website. We’ve included an incredible amount of educational content to teach our systematic approach. You’ll know what it is, why it works and how our tools help you exploit the edge that we trade. The Start Here section will lead you through the process step-by-step.

If you have been trading for more than a couple of years and your technical analysis skills are strong, learning the system might not take more than a few months. You already have the raw skills, you just need to learn the decision-making process and our tools. If you are new to trading you can expect this to take at least two years and you will need to dedicate at least 20 hours a week to learning. The majority of your time will be spent learning basic trading skills. Trading is difficult and it takes time. We suggest that novice traders find a broker with no minimum commission charges. Only trade 1 share of stock at a time until you get your win rate above 75% for two months. You will make mistakes and you want them to be small before you increase your size.

If you are day trading you need $25K or more. We don’t suggest trying to circumvent the PDT (pattern day trading) requirements since you will often find yourself “handcuffed.” Day trading is hard enough without painting yourself into a corner. Build your account slowly and you will get there. Swing traders can start with smaller accounts, but you should not allocate more than 5% of your account to any one position.

No. If you learn our system and use our tools/research your probability of success will increase, but that still does not guarantee success.

Visit the product pages for Chat Room, Option Stalker, and Option Stalker Pro. They describe everything you need to know to get started using our tools. Additionally, please visit the Pricing Page for a side-by-side feature comparison. Option Stalker Pro is our flagship product and we suggest you read it’s dedicated page and manual carefully to understand it and the system we trade. Together, we highlight all of the features and describe the searches and when to use them and it explains the search variables offered in Custom Search.

In short, if you are an active trader you will want Option Stalker Pro.

The system is not automated. Your brain is still the most powerful computer in the world. Option Stalker and Option Stalker Pro will deliver accurate trade signals and great stocks, but you still need to use your trading skills for final confirmation.

The system is excellent and we are not selling it, we are teaching it free. Once you learn it you will see that our research and tools are the best way to trade it. You can spend thousands of hours patching together free resources, but they are no match for what we offer.

We currently offer US equities markets.

We try to keep our product prices as low as possible so we do not run special promotions. We do offer discounts for longer term subscriptions and by signing up for a year, you can save yourself almost 50% vs the monthly subscription rate.

I have to answer this question with a question. Do you trust track records? We don’t because many of these so-called track records are “cherry-picked.” We offer many ways for you to check our performance.

- During your free trial ask members in the chat room if they are making money. We don’t mind if you do this and we won’t interfere when members respond.

- Watch the trades in the chat room during the free trial.

- Watch the YouTube videos. In each daily video we recap the trades highlighted in the prior video. Go back weeks or months and watch those videos. In fact, check the YouTube videos that were posted during the biggest market crash since the Great Depression

We don’t want to win you over with old trades. We want to show you how we are making money today. That’s why we offer a free two-week trial. Visit Start Here to learn how to begin.

No brokerage account is needed. If you want to test our searches and trade signals you can use Option Stalker. It has real-time data provided by Intrinio (not all exchanges).

Option Stalker Pro has a version called ‘IEX’ that is perfect for after-hours research. During the day the IEX quotes in the lists and searches are near real-time and the search results are real-time. The IEX version does not have order entry and the daily/intraday charts are updated after the close of trading. If you are a swing trader who conducts after hours research you will not notice any difference.

If you are active during the day and you want to try Option Stalker Pro, we suggest opening an account with Tradier Brokerage. It has been our experience that they get the account open in 24 hours and they will turn the data on right away. You do NOT have to fund the account for 30 days. This will allow you to use Option Stalker Pro with real-time data during the free trial. If you like Tradier Brokerage, they have incredibly low commission rates ($10/month for unlimited stock and options trades).

On the website please click Help at the top of every page. We will answer your questions during market hours. Please avoid the opening bell since we are trying to get the morning comments posted. Often we are available after market hours – try us.

Yes. We have an extensive library of articles located under The Edge in the top menu. You can find step-by-step instructions on how to explore our website in the Start Here page. Please begin with Our Trading Methodology. We suggest that you read as many of these articles as possible. Some of them are available to the public and some are only available to paid members. You will also find educational videos and our eBook. Annotated charts are posted to the chat room to highlight specific trading patterns. In short, everything OneOption touches has an element of education.

All of the research you see is done by our founder. He spends hours each day analyzing the market. Everything starts with the market so we need to get it right.

We do not offer personalized training or mentoring, but we do provide daily education in everything we touch. We have to communicate en masse. Members are expected to have a general knowledge of technical analysis, options strategies, and options pricing. The concept of time decay and implied volatility are important. We extensively use vertical spreads and when conditions are right we also buy options.

Membership, Billing

You can do this by clicking Account. Please choose a name that is tasteful and not too long. This is how other members will come to know you.

You can do this in the Account page. Please don’t change emails often. This is the key to your account and it is used for billing and permissioning.

Please contact us by clicking Help. We will move any remaining time over to the new subscription. It will bill at the new rate and duration. If you wait for your current subscription to expire, please remember to cancel the auto renew for the old product before signing up for the new subscription.

You can change your credit card information in the Account page.

OneOption does not collect your credit card information. We use one of the world’s largest transaction gateways (Authorize.net) to process payment.

Shorter term subscriptions give you a chance to try us out. When the shorter term subscription expires you will be able to take advantage of longer term cost savings. We’re glad that our product and services are working out, but we do not apply credit from previous payments.

Your user name and password are the same for Option Stalker Pro and the website.

Yes. For more information on that subscription please visit the Pricing page.

You will find a detailed comparison of our products and features on the Pricing Page.

We suggest starting with a shorter term subscription because we do not offer refunds. If you like our trading technology after using it for a month or two, subscribe to a longer term and save money. The days you have left on the old subscription will be added to the new subscription.

No. We offer a two-week trial. If you are still not sure if our products suit your needs, sign up for a month. The term is short so there is no long term commitment. We suggest that you start with a shorter-term subscription.

Login to the website and click Account. Next to your subscription you will see the word cancel. Click it and the auto-renew will be deactivated. You can continue to use the product until it expires. If you change your mind and you want to continue, click Activate next to the subscription and the auto-renewal will be turned on.

Yes. You can cancel the auto-renew at any time in the Account area and continue to use the product until it expires.

Chat Room

It is located at the top of the left margin of the chat room. If you are using a cell phone, look for the three horizontal lines and click it. If you are using a device with a larger display you will see the left margin and the icons at the top. This is where you can adjust the chat room settings.

These searches are found in the chat room menu by clicking the chart icon and they are the best searches given the current market conditions. We can change them to adapt to market conditions and the results update every few minutes.

The trade signals at the top of the chat room are buy/sell signals for the SPY generated from our trading system. When we view the signal across multiple time frames it helps us gauge the strength of the current market move. If all of the signals agree, the move is strong and you can increase your trading size.

The chat room is laser focused on symbols and entries. We ask that traders post entries on a timely basis and all exits must be posted on a timely basis. We ask that members stick to posting trades and that they keep the chatter to a minimum. Profanity is not allowed in the chat room. Learn more.

If we are buying stock/futures to open we say we are “long ABC.” If we are buying to close we say “bought ABC for gain” (or loss). If we are selling to open we use “short XYZ.” If we are selling to close we use “sold for gain” (loss). It won’t take long to understand. This way we know if someone is selling a long position vs selling short to initiate a position. We are always more interested in the entries than the exits. When we refer to lod that means low of day and hod is high of day. A strong bid means the market wants to go higher. If you are trading options, please state the month and strike.

Featured Traders have red user names. These pros have been hand-picked and these are the traders you want to watch. They have mastered the systematic approach we use and we would match them against any other trader.

You have the ability to mute (uncheck) any other member in the room. Once you do that their posts will no longer appear. That feature is found in the chat room menu by clicking on the icon with heads.

They are professional traders who have consistently demonstrated their skills over a number of years. New members need to know who to trust, these are the people you want to follow. They are posting trades and answering questions because they want to give back to the trading community. They trade for a living and they do not owe you anything.

No. They are not employees of OneOption and they are not paid. They are sharing their trades with other pros and when they have time they are trying to give back to the community by answering questions. They owe us nothing so please treat them with respect. They hunt here because they love the system, the tools and the culture we have created.

These are long standing members who have consistently proven their ability to find great trades that fit the system we trade. They are not paid and they are not full-time traders yet. Their names are in orange and when they post symbols you should take notice.

Yes. In the chat room menu, click the gear icon. You will see the search feature listed first. You can search by topic or key word and you can also search by username (make sure to define a date range).

Free trial takers can’t post during market hours. We need to keep the chat room clutter-free during market hours so that we can focus on trades. These users can post during non-market hours. We will make time to answer questions after the close.

We do not offer this feature. In the past we had members soliciting other members and we stopped offering it. Private messages also fragment us and we want to promote a unified community.

We do not offer other chat rooms. The trading during the day is fast paced and geared towards short term trades. We encourage swing traders to be more active in the evening and during weekends.

We discourage this. You will always be chasing your tail. You will not be learning the system, you will not know what to do if a trade moves against you and you will not know what motivated them to take the trade. That means that you will not know what to correct when you review the trade. Learn from these trades. Bring the charts up and study the patterns they look for on a longer-term and shorter-term basis and then set up your own rule base. You need to learn how to do this for yourself.

This feature is in the chat menu. Click the gear icon to access settings and turn off the sound.

Yes. You will find a switch in the upper right corner of the chat room.

When you enter a trade with a bullish bias, start by clicking the green box above the text box. Then enter the stock symbol in capital letters. If you do this the trade will appear in the trade log. You can add more detail to describe the position. For instance, if you are buying puts (long puts) that is a bearish position. You would click the red box and enter the stock symbol. Then you would mention that you are buying puts and you can provide the specifics. When you exit a trade, start by clicking the blue box and then enter the symbol.

Option Stalker

Option Stalker offers the best elements from Option Stalker Pro in a mobile app. It includes our indicators, favorite searches, trade signals and charts with real-time data (not all exchanges). You can create your own custom searches and watchlists. When the SPY signals agree across multiple time frames and the stock signals agree across those time frames, you have the makings for a great trade. Option Stalker does NOT include the chat room, it must be purchased separately. Learn more about how the features compare on our Pricing Page.

If you are an active trader, we suggest going with our flagship product Option Stalker Pro. It is our desktop platform and the subscription includes the chat room and Option Stalker. Though there are simply too many additional features to list here, you can learn about all of them on the Option Stalker Pro product page.

The chat room is a separate subscription, but we do offer a bundled product with Option Stalker and the chat room. You will save money by purchasing them together.

Yes. There is are online manuals for Option Stalker and Option Stalker Pro. The Option Stalker Pro manual is very complete and we suggest that Option Stalker members refer to it for information on the searches and the search variables we offer.

The bid/ask is accurate and very close to the NBBO, but the last price may not match other data sources because the trade might have occurred on another exchange. Volume is also not accurate in terms of an absolute value because the data does not include all exchanges, but we have found that the percentage above and below normal is fairly accurate and that is why we graph volume in those terms. For our purposes, the data source works well. Before placing a trade, we urge you to check the prices and charts with your online broker when placing trades.

Most people believe that data is free. In fact, it is incredibly expensive and tightly regulated. We feel that our data solution works for our application. It allows us to keep our product prices low and it reduces the amount of paperwork required. Your broker offers real-time NBBO data and we suggest confirming the prices and charts when you enter your orders.

We only offer order entry in Option Stalker Pro and members need to connect to one of the 3 broker APIs we offer. You can’t place trades in Option Stalker.

We do not offer that functionality in Option Stalker. Given the limitations of the Intrinio data feed, the candles are not likely to match real-time consolidated data feeds. The line charts are a good representation of the price action and you can confirm your trades using the candlestick charts in your broker’s application.

We offer the 1OP indicator, 1OSI and 1OVol. Option Stalker provides you with the trade signals, the stock searches and a general view of the price action. Your final analysis should be completed using your broker’s application.

Day trading from a mobile app is difficult and only you can make that determination. Visually confirm your trade with indicators, charts and prices offered by your broker before entering trades.

It is best to wait for all of the SPY signals to be in agreement across all time frames and then to look for stocks that also have trade signals that agree across all time frames. You can filter those search results further by adding variables like heavy volume, liquid options, technical breakouts and momentum. If you wait for everything to line up, your probability of success will be the highest. This means that you will not always be trading.

The search results and the trade signals are the same in Option Stalker and Option Stalker Pro. Only you can determine if day trading from your phone is viable. If you are able to use a desktop PC during normal trading hours we encourage using Option Stalker Pro with one of the broker APIs we offer.

In general we prefer buying stocks when all of the SPY signals and all of the stock signals are in agreement. We prefer buying stocks that are in the upper half of the chart and that are breaking through technical resistance on heavy volume.

We do not currently offer this feature.

We do not send alerts.

Option Stalker Pro

To copy your workspace files over to a new computer, navigate to: “C:\Users\yourName\AppData\Roaming\Option Stalker Pro\your@email.com” (AppData is a hidden folder and needs to be revealed). Copy the files within this folder to your new computer to run OSP with an identical setup.

Option Stalker is Windows based and it will not work on a tablet. The viewing area is too small. It will work on a laptop or desktop that has Windows (or a Windows emulation program for Mac users).

Option Stalker is a Windows based software program and Mac users need to have a Windows virtualization program like Parallels installed on the computer. Many Option Stalker members are successfully using Mac computers with these virtualization programs.

Alternatively, Mac users can use an Apple solution called Boot Camp that installs Windows on the hard drive. This will allow you to run Windows based applications like Option Stalker. To learn more please click this link to Apple’s website.

OneOption has negotiated this special rate with Tradier Brokerage – $10/month unlimited commission-free stock and option trades. Tradier Brokerage does not restrict data like other brokers do and I have always been able to reach their support desk. From my experience Trader Brokerage typically opens accounts within 24 hours.

Click here to open an account.

Yes. Option Stalker has excellent order entry and multi-legged spreads are a snap. Just click Trade at the top or bottom of Option Stalker. The pop-up will default to the stock in your primary chart and it will immediately call up an option chain. If no options are selected the order will assume you are trading stock. For more information on placing orders, please refer to the manual.

The Option Stalker Pro manual is available here. It is a fantastic resource and it describes the searches in detail. We highly recommend spending time reviewing this manual. There are tools that will help your trading.

Yes. Click Trade at the top or bottom of Option Stalker. In the pop-up you can select the Portfolio and Orders tabs to see your positions and trade log.

You can trade stock right from the charts. First you need to define a dollar amount you would like to allocate to the trade in the blank space at the bottom of the chart. Then click Buy at the bottom of the chart and you will see prices in the right axis of the chart. If you are short stock, it will load the quantity you are short. If you have no position it will use the dollar allocation you have set. Simply click the price you want to buy and the order will be placed. If you have no position and you place a buy order above the current price the system will know it is a buy stop. If you place the order below the current price it will know it is a buy limit order. This same logic is used on sell orders. If you are long stock and you place a sell order that quantity will load. For more information on all of the order entry features please refer to the manual.

If you are using a broker API, you can view real-time option quotes by clicking the Trade button below. Then select the expiration you would like to view and the data will populate.

If you are using the Option Pricing tab above the chart, this is where you can get all of the “greeks,” but the data is end of day. Click on an option and you can see a chart of the stock volatility and option IV along with the delta and other “greeks” in the header.

We do not send alerts. When you set an alert line in Option Stalker Pro, a pop-up will appear when it is triggered. Those alert levels reside on your computer and you have to have the computer on at the time the price condition is met.

If you want to monitor a spread or single-legged option you can configure the order but instead of clicking Submit, you select Stage. The order will appear in the Stage tab where you can track, modify, cancel or submit the trade with one click. This is a great feature when the market is moving quickly and when you want to have them ready.

The alerts are “live”, but we want to keep the charts clean so we do not display the lines. If you want to test them, set an alert above and below the current price on a five-minute (5M) chart.

For Lists and Searches you can expand the table to see all of the time frames by clicking the small box in the upper-right corner of the table header. It is right next to the “X”. This is how you expand the pane in all Windows products.

When you create your own Custom Search, name it and save it, it appears under My Searches. Our Lists and Searches have an Option Liquidity filter marked by default so that you can focus on the most liquid stocks. You will see this filter in the header of the List. When you “unmark” the box you will see all of the results and they will match Custom Search results.

These are diagonal alert lines. Select Alert and the line is good for the day. Select GTC and the line is good until it is triggered. To draw an upward sloping line click on the lower half of the starting candle and the lower half of the end candle. The line will be drawn and when triggered you will get an alert pop-up. To draw a horizontal alert line, click on the same candle twice. These lines are great for trade entry and for managing your exits.

Place the cursor anywhere on the chart, type the symbol and hit enter. Please spend time reviewing the Option Stalker manual. It will answer all of your questions and you will learn how to get the most out of Option Stalker. For instance, it describes our favorite searches and under which market conditions to use them. The manual also explains how to use diagonal alert lines to trade.

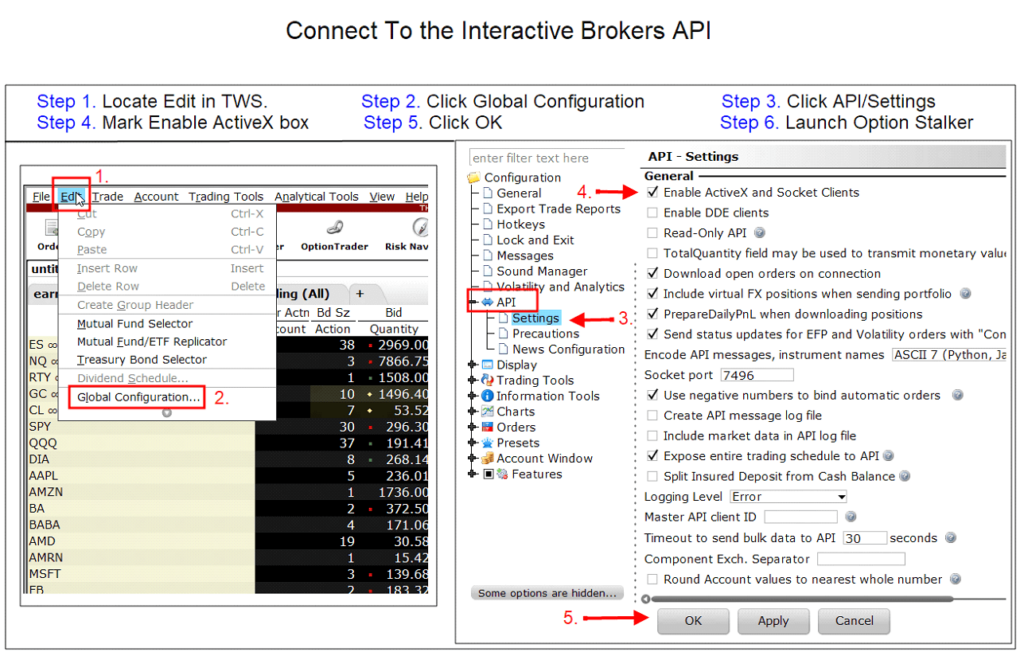

Please find Edit in the Interactive Brokers platform (TWS) and then select Global Configuration. Click it and then select API and then Settings. Please make sure the first box (Enable ActiveX) is marked. Also make sure that your port setting is 7496 and that the Read‑Only box is not marked.

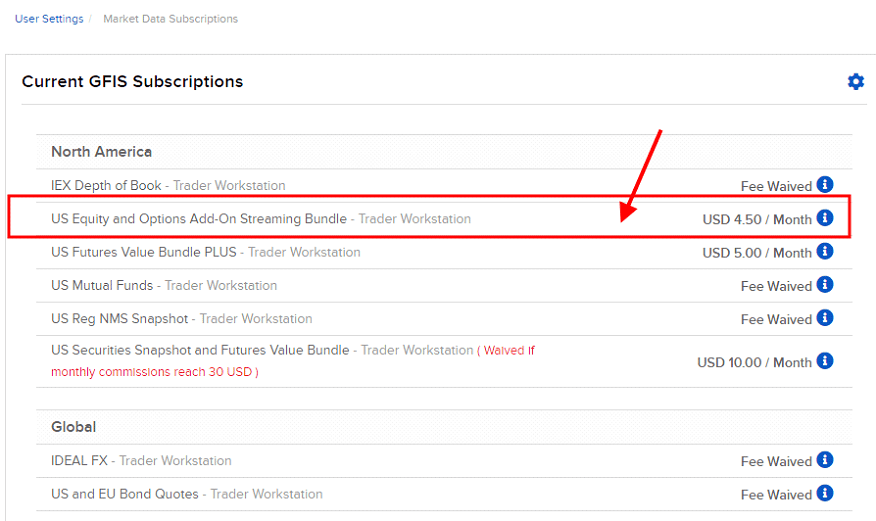

You need to sign up for the IB North American US Equity and Options Add-on Streaming bundle for Trader Workstation. You can do that through the IB Client Portal under User Settings and Market Data Subscriptions. Please don’t fight me on this. If the chart is stuck on SPY, this is what you need to do.

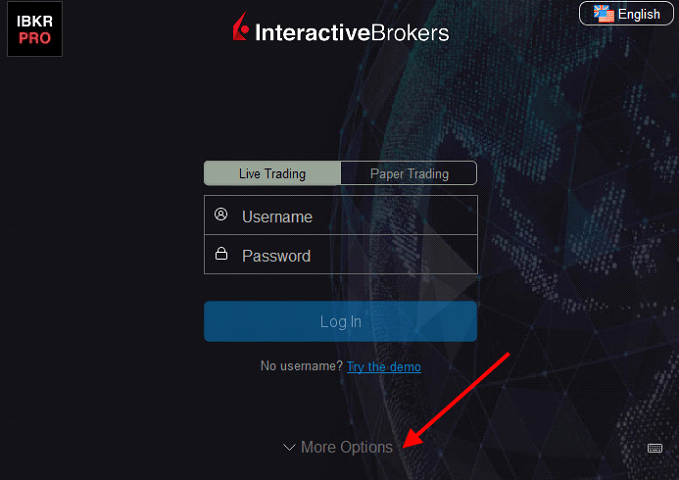

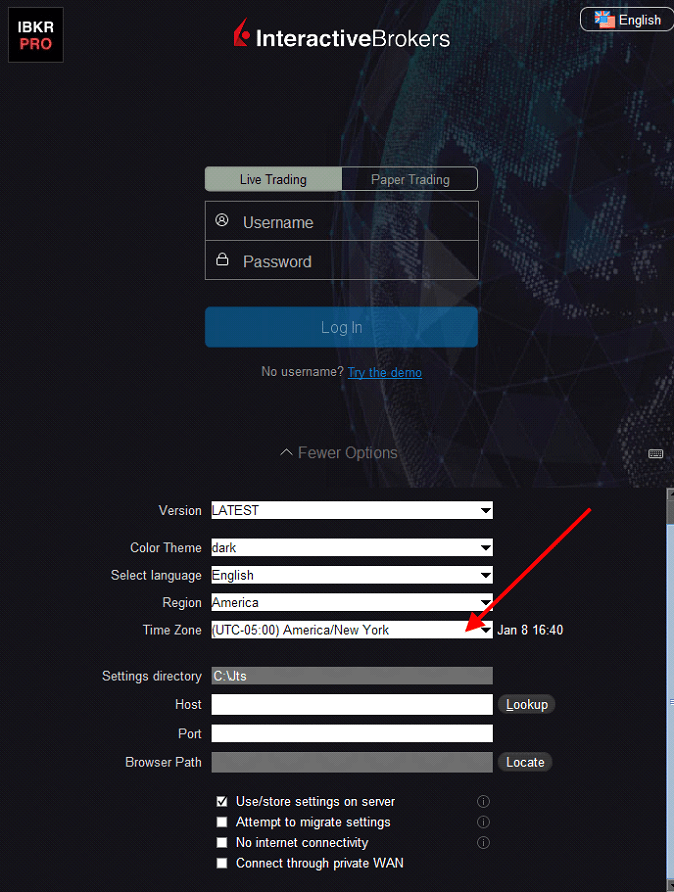

To solve this you need to change the timezone settings in IB TWS to match your computer timezone. Here is how you do that.

Trading / Other

There are at least two new videos posted to YouTube each week and I highlight swing trades and day trades in those videos. Most of the trades in the chat room are day trades, but we do highlight swing trades as well. You should also know that before we day trade a stock, we must also like the stock on a swing trading basis. If you are a swing trader, use the longer-term variables (H1, H2, H4, D1) in Custom Search and make sure you have Trade Signal marked. Those stocks will be well suited for swing trades.

Our research for full-time traders is ongoing. It starts with the Pre-Open Market Comments and it continues the entire day. We highlight the stocks that you should be focused on and two of our top searches will alert you to some of the best stocks in the chat room. We are constantly searching for stocks to buy/short and posting them in the chat room. The YouTube videos will highlight those stocks and we will describe what made them so attractive. The chat room also includes S&P 500 day trades, option lottery trades, and excellent trade ideas from our members.

We only offer our desktop software as a complete package with all of our products. When you try it we are confident you will appreciate its value.

Tradier Brokerage will typically open an account the same day and they do accept foreign accounts. Please check with them to see if they are licensed in your country. They do NOT require funding before they turn the data on. This will allow you to take the free trial with real-time data in Option Stalker Pro. They will turn the data off if the account is not funded in 30 days. Tradier Brokerage also has low commissions. $10/month flat fee unlimited stock and options trades.

We look for deep troughs and big spikes. Those signal crosses produce the strongest bullish and bearish reversals respectively. The indicator is predictive (not reactive) and it is true 80% of the time. There are divergences when the market is in a strong directional trend and this happens 20% of the time. These divergences are also very powerful and we know when to look for them. There is an entire section about 1OP in Tutorials. I suggest you watch those videos.

Honestly, there are so many. We may only use the Bullish Explosion search a dozen times a year, but that search will pay for itself in one trade. Heavy Buying is a favorite on the opening bell. When the market drops and support is forming I look to Relative Strength 30. These stocks are strong relative to the market and they are ready to run as soon as the market finds support. This is how I trade market reversals.

PopBull is our favorite swing trading search. It looks for compressions and technical breakouts on heavy volume (coiled spring). During earnings season, Strong After Earn is my favorite search. It looks for stocks that have recently posted earnings. These stocks gapped higher after the number and they are still trading above the opening gap price. These are great for selling bullish put spreads. Pre-Earnings Bull is also excellent. These stocks will report in the next two weeks and they have rallied two weeks ahead of the number 75% of the time during the last 12 quarters. These stocks are also great for selling bullish put spreads. These are all excellent searches.

Option Stalker Pro knows every 20-day average volume for every five minute period for every stock. When we see something unusual we get an Explosion Alert pop-up on Option Stalker Pro. It means that there is incredibly heavy volume and a dramatic price change. If you recognize the symbol and it is a big company it will probably be a good one. When you see an alert for GOOG, EBAY or BIIB you know it will be good (all have been recent explosions). Large cap stocks are hard to move and this news is always material when it hits the wires. These alerts are so timely that we get in right when the move is happening. I like to look at a daily chart to see if the stock is through major horizontal resistance. If it is I like it even better. I go to the five minute chart and I want to see a long green candle on its high and I want it to hold. I like to click the Buy button and quickly drop the buy line at the current price. I don’t mess around with these. You have to buy them fast. If the move is not happening in 10 minutes I will get out. These are rockets most of the time.

The fastest way to learn about Option Stalker Pro is to read the manual located on the download page. It details all of the features and it highlights our favorite searches and under which market conditions to use them. The videos on the Tutorial page are an excellent resource and you will see Option Stalker Pro in action with all of its features.

We stick to our proprietary indicators 1OP, 1OSI and 1OVol. We also use major moving averages on a daily chart and EMA (8) on a short term basis. We also use trendlines and horizontal support and resistance. We also use candlestick analysis.

You should use indicators that you have confidence in. Please don’t ask for our opinion on other indicators, we don’t use them.

Books have been written on the topic so let’s keep this simple. If you are learning how to trade, you should be trading 1 share of stock until you get your win rate above 75% for a few months straight. When you get there you will have plenty of experience and you can gradually increase your size. If you are a seasoned trader with good success, use the SPY signals as your guide. When all of the trade signals for SPY across all time frames agree, you have optimal conditions and you should trade full size. Market conditions drive all of our trading decisions. When you have anything less, you should trade smaller size and there will be times when you should not trade.

Books have been written on this topic as well so let’s keep this simple. If your market bias is bullish and you bought a stock, stick with the position as long as the SPY signals remain bullish and as long as the stock maintains its relative strength. You can also use trendlines and the EMA8 as your guide.

Only if you have a 75% win rate for more than a few months straight. Options are the icing on the cake. If you do not have a high success rate you will lose your money faster by using leverage. If you get the market right and you get the stock right, you can trade almost any options strategy and make money. Focus on the first two elements.

Books have been written on this topic as well. It is our philosophy that if you need to hedge, your market confidence is low. Instead of hedging your positions, we suggest that you trim your exposure. Hedges do not always work properly and instead of managing losing positions and hedges, we prefer to look for new opportunities with our cash.

Enter every trade as a swing trade and only in rare circumstances should you exit a trade the same day. Trying to circumvent this rule will force you to make bad day trading decisions. When you need to exit a trade the most, you might not be able to. Grow your account slowly with swing trades and you will get there quicker than you think.